Top news story in the Wall Street Journal on October 8, 2012: Investors and analysts agree that the coming earnings season is likely to be bad, but there is a debate about how much the expected gloomy news is likely to influence the stock market, thanks in large part to stimulus moves by the Fed.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.

Thomas Climo, PhD, is a dental practice management consultant and a past professor of economics in England.If earnings (read "net income") is such a significant part of the movement of the largest holdings of money on the various stock exchanges in the world, and only an injection of an unthinkable amount of funding and/or a radical redirection of the otherwise free movement of interest rates by the Federal Reserve is capable of reducing this significance, why is it that in the much smaller world of dentistry, earnings are thought to be an insignificant consideration inferior to revenues and percentage of revenues?

Could it be that dentistry is out of touch with the dynamics that help establish business value? For example, "net income" and "cost of capital" -- phrases paramount in understanding the value of companies and their stock market or private equity pricing -- are never employed when discussing the sales pricing of dental practices.

Or could it be that dentistry has not paid much attention to the importance of earnings because its practitioners prefer to think of their practice(s) as a vehicle for spending off-clinic money rather than as an important part of the preservation of value in their business?

Since dentistry is the only business in the world that sells its end product -- dental practices -- for an amount less than its prior year's net collections or revenues, allowing earnings to play no part in this valuation, then we must ask whether dentistry is such a unique field of business activity that the precepts and derivatives that surmise and drive the remaining industries in the world are out of touch with dentistry, or whether instead it is dentistry that is out of touch with the rest of the world. I have made a consulting career out of arguing the latter, and do so again in this present essay (see sidebar, "Supporting the proposition").

|

Supporting the proposition The following six articles should establish the accuracy of the proposition that dentistry is out-of-touch with the dynamics that help establish business value:

This last article is my attempt to reconcile the dental industry's use of revenues and percentage of revenues as a basis for sales price against that of net income and net income margin. As far as I am aware, this is the first attempt to unite pricing of practices in dentistry with economics. However, as I make clear at the tail end of the article: "Financial statements of dental practices cannot be taken 'as is,' as often owner salaries as an operating expense masquerade as balance sheet withdrawals instead of the legitimate appearance on the profit and loss statement. Also, depreciation is a much ill-treated matter in most of these financial statements. The net income margin I use is based on the economic net income I derive from recalibrating the dental practices financial statements." |

Progress is inevitable

In motion pictures, a usual feature of storytelling is to display the loner as a maverick standing meritoriously against the overwhelming mediocrity and mendacity of the crowd. The Rock (Dwayne Johnson) does so in "Standing Tall," Bruce Willis in all of the "Die Hard" movies, James Dean in "Rebel Without a Cause," and no one can forget the "Man with No Name," Sergio Leone's creation of the Clint Eastwood fast-gun character.

Of course, each one of these films represents fiction. Fact is -- and here we can turn to a nonfictional Wild West character, Wyatt Earp, who was tried for first-degree murder in a court of law for his participation in the so-called gunfight at the O.K. Corral -- no one gets to circumvent the laws of the state or the federal government and not incur consequences of breaking those laws. In other words, in the spirit of civilization, the crowd behaves as it does for order, progress, and evolutionary efficiencies.

A gorilla who is used to eating hyena dung does not return to dung when suddenly presented bananas. Similarly, humanity, when shown a better way of doing things -- whether in cooking with gas, traveling by the internal combustion engine, or splitting the atom -- doesn't revert to a time when these inventions were not present. Those who do are labeled iconoclasts, fuddy-duddies, or given other demeaning names.

Changing with the times is progress. That's just the way it is.

Who would read Adam Smith's 1776 The Wealth of Nations and not modify its findings in light of John Maynard Keynes' 1936 The General Theory of Employment, Interest and Money? Who would not move from Keynes's internal rate of return as a method for adjudicating investment projects to Irving Fisher's net present value (NPV)? Who wouldn't accept the more than 70 years of theoretical findings and the empirical research of Fischer Black confirming the formula for the economic value of a project, whether by an individual or company, and the concomitant association of same with free cash flow, or net income, and the cost of capital, or the hurdle rate through NPV necessary for determining the acceptability of an investment at a given sales or purchase price?

No one, that's who!

When those advising the dental profession, whether certified public accountants or appraisers, determine valuation and sales price from a perspective different from these 70 years of theoretical and empirical research, this economic advisor calls into question the veracity of the advisement. In fact, this economic advisor argues that their advisement is wrong, capricious, a maverick against the crowd comprising the stock exchanges of the world and private equity investment.

Realistic economic methodology

A dental economic methodology predicating the value of dental practices on revenues and percentage of revenues has no grounding in the economic methodology that every other business in every other industry in the world uses. This includes every analysis of every company on the New York Stock Exchange, and every analysis of every company by private equity groups.

"Give it up" is the call to arms of a profession out of date with modern prescriptions of business valuation and sales pricing.

When dentistry does finally give up revenues and percentage of revenues as the barometer for its sales pricing, it will graduate from being a cottage industry and fall in with the crowd ... where it belongs.

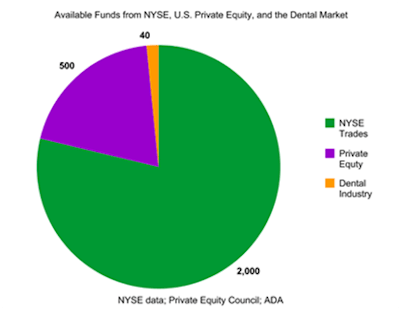

Not wishing to have myself judged as capricious, take a look at the size of the other two groups in the crowd the dental industry will be joining (in billions, of course):

|

The dental industry is swamped by the availability of investment funding from a single stock exchange and the private equity investment from only one country. It is also suitably swamped by private equity investment alone.

It is time for the dental industry to join the crowd.

Thomas Climo, PhD, is a professor emeritus of accounting and finance at a major university in the U.K. He has published extensively about the importance of modern managerial and financial decision-making for dentistry. He is a consultant to corporate and solo practitioner dental practice management companies in the states of Arizona, California, Connecticut, Nevada, New Hampshire, New York, and Massachusetts. He can be reached by email at [email protected] or by telephone at 702-578-2757.

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.