Whether we like it or not, 2013 is the beginning of a new tax reality in the U.S. A new tax bracket and additional taxes to pay for healthcare make qualified plans an even better tax solution. Above-the-line tax deductions are scarce these days; contributions to qualified plans reduce both taxable income and adjusted gross income (AGI). This translates to lower tax brackets and, therefore, minimizes the impact of new tax rates.

Therefore, now more than ever, qualified retirement plans can have a measurable impact on your tax bill.

Here are some key 2013 tax changes and how a qualified retirement plan may provide you with a solution to these increases:

Investment tax: An additional 3.8% tax on unearned net income is now imposed on individuals whose AGI is more than $200,000 (or $250,000 for married couples). This is in addition to the capital gains and dividend tax increase from 15% to 20%.

The qualified retirement plan solution: Investments held in a qualified retirement plan are never subject to investment tax.Medicare tax: There is an additional 0.9% Medicare payroll tax on wages/earned income above $200,000 for individuals (or $250,000 for married couples).

The qualified retirement plan solution: Dollars contributed to the plan that would otherwise have been paid in the form of wages (not self-employment income) avoid Medicare tax entirely.Phase-out of deductions: The ability to itemize certain deductions is phased out for individuals whose AGI is greater than $250,000 (or $300,000 for married couples).

The qualified retirement plan solution: Contributions to retirement plans have not been phased out.Top marginal rate: The top rate has increased to 39.6% for individuals whose taxable income is above $400,000 (or $450,000 for married couples).

The qualified retirement plan solution: Contributions to a qualified plan are deductible, and may cause earnings to drop low enough to prevent inclusion in the top marginal rate.

Wealth accumulation

Not unlike the importance of diversifying investments within a portfolio, accumulating savings in a qualified retirement plan provides a meaningful supplement to other accumulations of wealth such as your practice, partnership interests, or real estate. How much will you need at retirement? A cash balance plan will allow you to accumulate significantly more than a 401(k) plan over the same time frame.

In addition to tax deferral and wealth accumulation, qualified plans are a great tool for employee recruitment and retention. A cash balance plan, when paired with a 401(k) profit sharing plan, can provide understandable benefits for your employees with the design flexibility to suit your specific needs.

A case study

Joe and Tom, partners in a dental practice, came to us looking for help. Joe had owned the practice for several years, while Tom was a new owner. Both were interested in accumulating wealth for retirement, but they recognized that they were in different places in life.

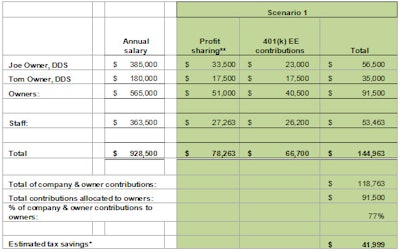

We started our discussion with their existing Safe Harbor 401(k) Profit Sharing Plan (Scenario 1). By defining each individual as his own group, we could allocate the maximum to Joe and a slightly lower profit sharing to Tom (due to their varying retirement plan goals). The cost is 7.5% of compensation to the employees. This resulted in 77% of all employer money allocated to Joe and Tom.

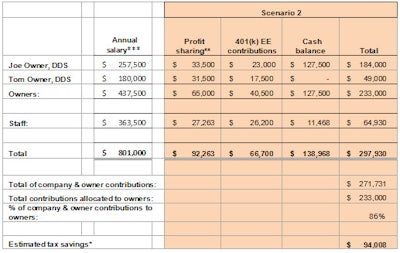

However, Joe really wants to put away more than the defined contribution maximum. Based on the demographics, we found that we could add a cash balance plan and define a contribution credit of the lesser of $127,500 or 50% of compensation for Joe (Scenario 2). Along with this, we have a cash balance credit for the staff of the lesser of $1,500 or 3.5% of compensation (total cost is just under $11,500).

At this point, we did not include Tom in the cash balance plan; however, he did increase his profit sharing amount. This resulted in 86% of all employer money allocated to Joe and Tom.

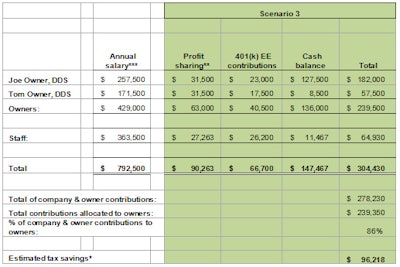

Finally, Tom decided that he wants to participate in the cash balance plan also (Scenario 3). Without further increasing the staff cost, we found that we could define a contribution for him of the lesser of $8,500, or 5% of compensation. This resulted in 86% of all employer money allocated to Joe and Tom.

Joe and Tom are very happy with the progression of their plan design. Tom understands that if he wants to cut back his contributions in a given year, he may simply reduce his deferrals or his profit sharing allocation.

* Assumes 34% company tax rate and 38% owner individual tax rate.

** Profit sharing amounts include safe harbor nonelective contributions.

*** Reduced due to allocation of cash balance contributions from salary to qualified plan contributions.

Plan designs are for illustration purposes only. The costs mentioned above do not consider the tax savings the company and owners are able to take as a result of implementing a retirement plan. The illustrations demonstrate the tax savings from the various plan scenarios.

You may be able to claim a tax credit for part of the ordinary and necessary costs of starting a qualified qualified plan.

Sheri Alsguth is a senior manager at Pinnacle Plan Design, where she specializes in designing retirement plans to maximize the benefits for business owners and principals. She can be contacted at 520- 618-1305 or [email protected]. Pinnacle provides qualified retirement plan design, implementation, and administration services.

Any U.S. federal tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, by the recipient for the purpose of avoiding penalties under the Internal Revenue Code or applicable state or local tax law provisions.