Align Technology's Exocad will participate in the 2021 Dental South China (DSC) trade show in Guangzhou, occurring May 10 through May 13.

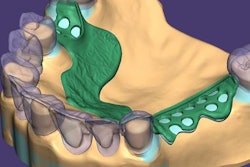

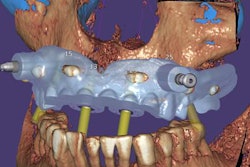

Exocad will showcase its newest software DentalCAD 3.0 Galway and its other open software solutions at booth C20 in hall 15.1. The company also is launching its 2021 antisoftware piracy program at the event.