DrBicuspid.com is proud to present an excerpt from Dr. Roger P. Levin's latest book, What Dentists Can Learn From Top CEOs. This book draws together many observations about how techniques used by top corporate leaders can be applied successfully in dental practices.

The following is an excerpt from the chapter "CEOs Analyze Finances & Overhead."

It all starts with the budget.

Roger P. Levin, DDS, chairman and CEO of practice management consulting firm Levin Group.

Roger P. Levin, DDS, chairman and CEO of practice management consulting firm Levin Group.The financial cornerstone of any operation is its budget. Budgeting -- the projection of what will be spent by the practice in a given year -- is an indispensable skill for the practice leader.

In simple terms, there are two types of expenses in the budget -- fixed and variable. Fixed expenses do not change based on how the practice performs. Variable expenses rise or fall based on the volume and nature of production. Together, they represent practice overhead -- the cost of doing business as a dental practice.

Analyzing expenses and projecting a budget can be accomplished either by the dentist alone or in conjunction with an accountant. The accountant's financial expertise justifies the fee charged, but keep in mind that few accountants are experienced in the specifics of budgeting for dental practices. Input from the dentist will be needed.

How does the budget compare, and can overhead be cut?

Think of budget and overhead as works-in-progress, subject to periodic review and change.

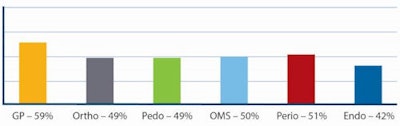

Once the budget projection has been set, compare it with the previous year's budget. How does it look in terms of national averages? As you track spending (in compliance with the budget), you will also be adding up the overhead. For a given period -- monthly, quarterly, annually -- you will add up all expenses. Compare that figure to the total gross income of the practice for the same period. You will arrive at a percentage ... the practice's overhead percentage. Levin Group sets overhead targets for its clients. We know from our experience that these are healthy levels -- and that they are readily attainable. The following chart shows the current Levin Group targets.

Chart courtesy of Levin Group.

Chart courtesy of Levin Group.The goal is to reduce overhead, thereby increasing profit.

Most practices coming to us for consulting have higher overhead than what we recommend. However, as their production rises, variable expenses rise accordingly but fixed expenses do not. The result is a greater margin between expenditures and income, i.e., a greater profit margin. These Levin Group clients typically see a gross profit increase of $64,000 to $88,000 per year -- revenue that can go directly into the doctor's income.

Over time, budgeting shows you where you have been, where you are, and where you are headed. If you don't like what you see, the message is clear. You must either increase production, reduce expenditures, or both.

Budgeting goes beyond the practice.

What Dentists Can Learn From Top CEOs by Dr. Roger Levin.

What Dentists Can Learn From Top CEOs by Dr. Roger Levin.

Too many doctors set perfectly good budgets for the practice, only to undermine their gains by making bad spending decisions in their personal lives. This behavior can easily lead to long-term financial disaster.

A doctor friend once told me he was seriously considering buying a second home. I suggested he go through a basic budgeting exercise that encompassed both his practice and his personal life. It turned out to be good advice. The numbers made it clear that he would have to divert money he was currently putting into savings and college tuition accounts for his children.

Whether or not the second home would turn out to be an excellent investment, the timing was wrong. I pointed out that, according to the budget projections, he would probably be able to afford a second home in about two years -- without interfering with other plans. Budgeting kept him from making what could have been a costly mistake.

Conclusion

Practice success depends on many factors. Budgeting and overhead control are among the most important. Many dentists and specialists will simply go along in their careers without analyzing their financial situations. As long as there is enough money to pay the bills, they accept the status quo. Unfortunately, doctors with this attitude will end their careers frustrated and struggling to fund their retirements.

Highly successful dental careers are founded on basic but essential protocols. For example, dentists and specialists should always take a set salary and be paid every two weeks like the rest of the staff. Without this, it is impossible to create a proper budget. Another example of good fiscal policy is to compare actual practice expenses to the numbers projected in the budget every month. This is the only way the doctor can determine whether the practice is -- or is not -- on target.

Analyzing practice finances is not some dry exercise to make accountants happy. The right budget allows you to live your life as you wish.

Roger Levin, DDS, is the chairman and CEO of practice management consulting firm Levin Group.

Special for DrBicuspid.com members

Order What Dentists Can Learn from Top CEOs today and receive a $100 discount when you use code LG13100.

The comments and observations expressed herein do not necessarily reflect the opinions of DrBicuspid.com, nor should they be construed as an endorsement or admonishment of any particular idea, vendor, or organization.

Copyright © 2014 Levin Group, Inc. Reprinted with permission.